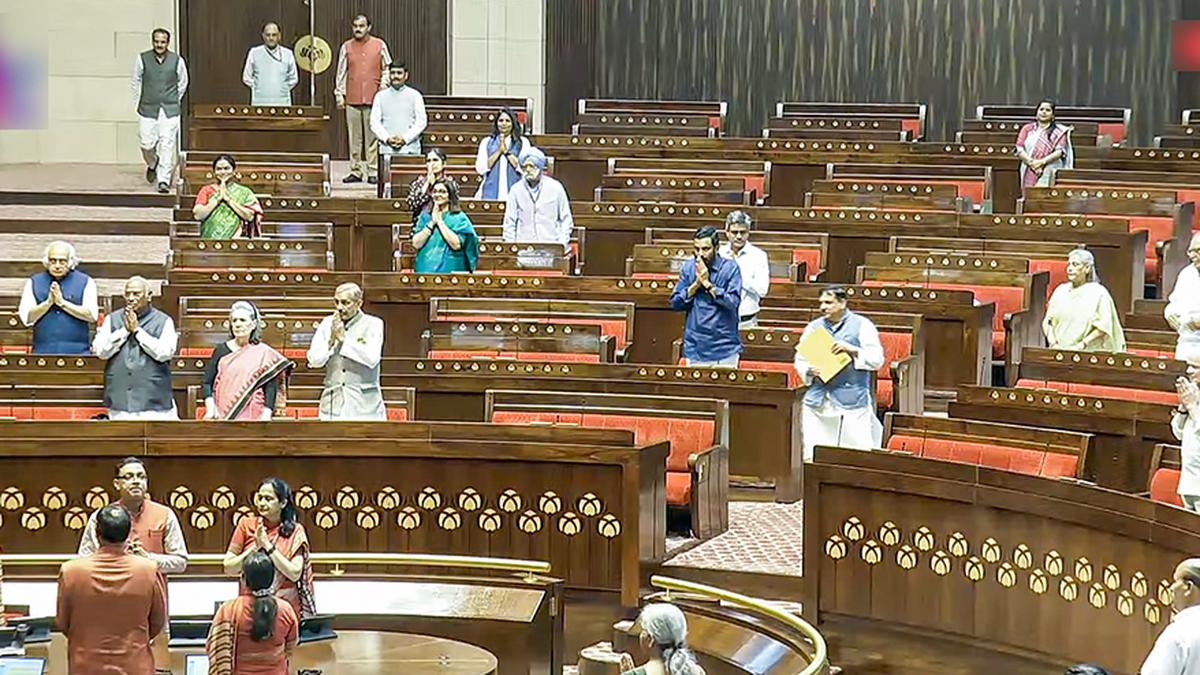

Opposition members in Rajya Sabha on Wednesday (March 26, 2025) raised concerns over the Banking Laws (Amendment) Bill, 2024, saying that the proposed legislation fails to keep pace with the rapidly evolving financial landscape.

Parliament Budget Session Day 11 LIVE

Participating in a discussion on the bill, Harish Beeren (IUML) said the Upper House must ponder over amendments to the five banking laws that are brought at “single stroke”.

“Certain provisions warrant deeper scrutiny and potential revision.” While acknowledging the intent of the bill, Fauzia Khan (NCP-SCP) raised several concerns about the proposed legislation’s narrow scope.

Also Read | Congress MPs meet Speaker, raise issue of denial of opportunity to Rahul Gandhi in Lok Sabha

She called for a dynamic approach to the Rs 2 crore threshold for substantial interest, suggesting it should be indexed to inflation and economic conditions.

Ms. Khan pointed out that the bill overlooks crucial challenges facing rural and cooperative banks, including high non-performing assets (NPAs) and technological infrastructure limitations.

Ms. Khan drew attention to the growing risks posed by emerging technologies, particularly artificial intelligence in banking. She warned about systemic vulnerabilities arising from overdependence on a small number of technology providers.

“The opacity of AI makes it difficult to audit and interpret algorithmic decisions,” Khan told the House, emphasizing potential risks of unpredictable market outcomes and increased cyber security threats.

Citing data, she highlighted that 4,016 cooperative banks have reported financial fraud in the last five years, underlining the urgent need for comprehensive digital risk mitigation strategies.

The parliamentarian questioned whether current legislative efforts are keeping pace with the rapidly evolving financial landscape, including challenges posed by crypto-currencies, online scams, and digital financial technologies.

P.P. Suneer (CPI) alleged that Indian banking system has been mismanaged to favour large corporate interest.

“Over the past 10 years, Rs 16.35 lakh crore bad loans have been written off, benefiting corporates.”

Countering the Opposition, Sikander Kumar (BJP) said the amendment bill has been brought to address loopholes.

The proposed amendments are not merely regulatory changes, these represent a bold step towards enhancing transparency, accountability, safeguarding the interest of investors, and rebuilding the public confidence in our financial institutions, he said.

The proposed amendments are a comprehensive legislative effort aimed at modernising and enhancing regulatory framework of India’s banking sector. It seeks to amend key banking regulations with the objective of improving governance standards in the banking system.

“Drawing lessons from the past mistakes, the Modi government is committed to rectifying the previous wrongs and ensuring good governance in the banking sector,” he added.

BJP leader Kavita Patidar said, “Through this bill, the government has given new direction and strength to the banking sector.

The amendments have been proposed to set right the wrong doings, she said.

Ms. Patidar alleged that during the UPA regime, there was huge corruption in the banking system. However, after 2014, the Modi government ensured that each one is connected with the banking system and funds to beneficiaries of welfare schemes are transferred directly into the bank accounts.

“Enforcement Directorate (ED) has detected thousands of frauds. About Rs 65,000 crore has been confiscated and changed the entire banking condition today,” he said.

V Sivadasan (CPI-M), Priyanka Chaturvedi (SS-UBT), Mahendra Bhatt (BJP) also spoke on the bill.

The bill proposes to allow a bank account holder to have up to four nominees in his/her account.

The bill also seeks to transfer unclaimed dividends, shares, and interest or redemption of bonds to the Investor Education and Protection Fund (IEPF), allowing individuals to claim transfers or refunds from the fund, thus safeguarding investors’ interests.

Lok Sabha passed the bill in December last year.

Published – March 26, 2025 06:29 pm IST